Selling your startup is more than difficult. However, if you feel that the time has come, your only concern will then be not to leave any money on the table. The potentially life-changing windfall of money that the sale of your SaaS startup can bring will set you up nicely for your next startup. Or that perpetual vacation if you’re ready to retire. This is where SaaS valuations come in.

No matter whether they are vertical or horizontal SaaS, SaaS startups looking to sell don’t stay on the market for long. Such is the demand from major tech companies who actively look for startups to acquire that can help improve their products and services. Institutional investors are also eager to get a piece of the action.

Despite their eagerness, expect no lapse in due diligence. They’ll only want to pay what they think your business is worth and not a dollar more. Often, they may even require a professional valuation of your startup once negotiations begin. Crafting a comprehensive SaaS proposal template can streamline the negotiation process and ensure clarity in communicating the value of your startup to potential buyers. It serves as a roadmap, outlining key metrics, growth projections, and unique selling points to bolster confidence in your business’s worth.

Before you get to that stage you do need to put a value on the business yourself. However, if you overvalue your startup most investors won’t even bother negotiating. At the same time, you don’t want to undervalue it. Nothing hurts more than selling your company for less than what it’s worth.

By valuing your startup properly, manually, or through a SaaS valuations calculator, you’ll likely get interest from more buyers. And will be able to maintain balance in the negotiations.

So, here’s how to properly value your SaaS startup.

How NOT to Value Your SaaS Startup

First, it’s important to know how NOT to value your startup. There’s a lot of conventional “wisdom” that tends to confuse founders, particularly if they’ve never sold a startup before.

Never value your business based on what one of your competitors sold for. Also, don’t let that price tag be the motivation to sell your startup either. You’ll never have the full picture of what went down in those negotiations. For example, it could have been a strategic acquisition for the buyer. Or your competitor just negotiated a better deal. The situation won’t be the same for you.

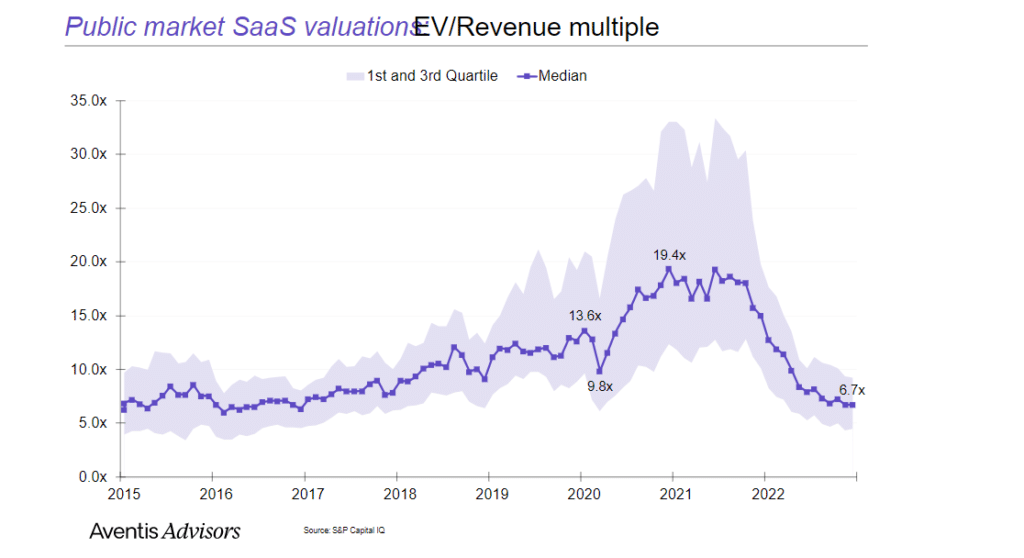

Another mistake founders often make is the perception that their startup can be worth as much as publicly traded companies in their industry. Even if your startup is a bona fide unicorn, it won’t fetch a similar valuation due to a variety of factors that influence a public company’s share price. Use those valuations as just one of the many data points that help you reach an appropriate value for your startup.

Last but not least, selling a startup follows the same rules as selling most types of businesses:

- What type of business entity to choose: deciding between LLC, C-Corp, or S-Corp based on liability, taxation, and fundraising goals.

- Filing a ‘Doing Business As’: understanding the process and cost of a DBA, for legal and branding purposes.

- Initial registration and incorporation costs: knowing the filing fees, state requirements, and potential legal/accounting expenses.

- State and federal tax obligations: including estimated taxes, sales tax, and compliance with annual filings.

- How to open a business bank account: understanding required documentation to separate personal and business finances.

- Basic bookkeeping and accounting tools: choosing tools to track income, expenses, and stay audit-ready.

- What business insurance you might need: evaluating risk and securing appropriate coverage like general liability or professional liability.

Therefore, it’s a good idea to have a business sale checklist to write down your to-do actions.

Now that you know how not to value your SaaS startup, here’s what you need to know to value it properly.

1. Find Your SaaS Multiple First

Valuation multiples make it easy to quickly value companies and compare similar companies in an industry. They’re then multiplied by a financial metric like EBITDA (more on this later) to figure out the valuation of a startup. There are many different performance, financial, and market factors that influence the multiple.

Instead of being overwhelmed by trying to figure them all out, focus on finding a multiple range in which your startup fits. As of Q1 2023, industry reports have projected SaaS revenue multiples at a three-year low, averaging a pre-pandemic level of ~5.5x

Be it good news or bad news, this data can be used as an indicator for private startups as well. What you need to do is figure out where your SaaS multiple fits in this range.

You can justify a higher multiple for your startup if it has been in business for over a year and its operations are self-sufficient and not entirely reliant on you. You’ll also need to demonstrate significant growth potential to back up a big multiple based on commonly used SaaS metrics.

2. Learn the SaaS Metrics That Matter

Buyers will look at the most important SaaS metrics to decide if your startup is really worth as much as you say it is. Evaluating these metrics together provides a more holistic view of your startup’s growth potential. The following metrics are the ones that matter the most:

1. Lifetime Value of Customer: The LTV represents the average revenue generated from a customer throughout their time with your business. Investors like to see a high LTV. It shows that the customers are happy to keep paying for your services.

A high LTV also justifies a high CAC (more on that later) since even though the cost to acquire a customer might be higher, they’re likely to keep spending money with the business over a longer period of time.

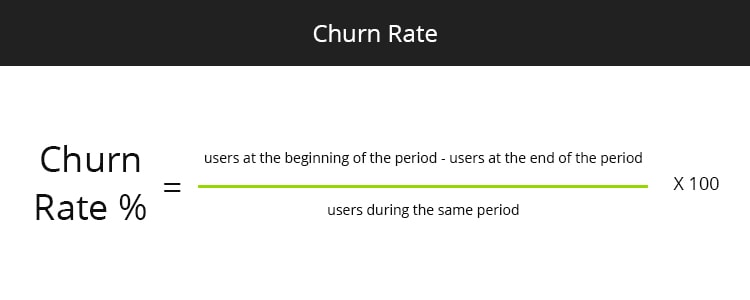

2. Churn Rate: The churn rate is the percentage of total users that unsubscribe and stop using your services in a period of time. For SaaS startups, the churn rate is one of the most important metrics that buyers will look at. It lets them know if your business is capable of sustaining growth.

A high churn rate is unfavorable as it shows that the business isn’t consistently bringing in recurring revenue. If your churn rate is lower compared to the industry average, it will have a more positive impact on the multiple. The opposite of churn, called retention, and the effort to increase it, should be a top priority for any SaaS company, regardless of potential evaluation. Long story short, it’s a lot cheaper to retain an existing customer than to acquire a new one.

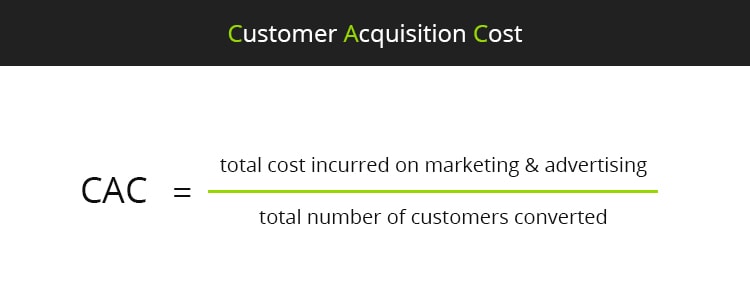

3. Customer Acquisition Cost: The customer acquisition cost or CAC is what you spend on marketing to acquire a new customer. Many startups focus on burning more cash initially to acquire customers. Suffice it to say, this strategy although sometimes necessary, doesn’t always pay dividends in the long term.

Burning cash to acquire customers is also not an uncommon practice even among big companies that are trying to grow. Take the example of Amazon Prime. It was estimated that Amazon was spending an average of more than $90 annually per customer to supply all of Prime’s services. That’s a net loss of at least $11 per customer, adding up to hundreds of millions of dollars in annual losses for Amazon. However, at the end of the day, Amazon didn’t lose any money. Amazon Prime helped Amazon dramatically increase sales and create hordes of loyal customers who now were part of the Amazon ecosystem.

However, as a rule of thumb, investors are not particularly interested in bankrolling high CAC. If it’s on the higher side for your startup, you’ll need to have a solid explanation for it if you want that multiple to remain on the top end of the spectrum.

3. Understand the Pillars of SaaS Startup Valuations

The right SaaS valuation is all about measuring the performance of your business now. Also, it’s about predicting with a degree of certainty how it will scale in the future. The resulting dollar value should inspire confidence in the investors. And that’s really what will get them to write that check.

There’s no magic formula that everyone can use to find the right valuation for their business. But we do have the pillars that all startup valuations are built upon. Namely, EBITDA, SDE, and Revenue. Find your startup’s value by applying the SaaS multiple to either of these three pillars. You can choose to pick one pillar over the other to give yourself a better valuation based on the profitability and maturity of your startup.

Using Earnings for Startup SaaS Valuations

What is EBITDA?

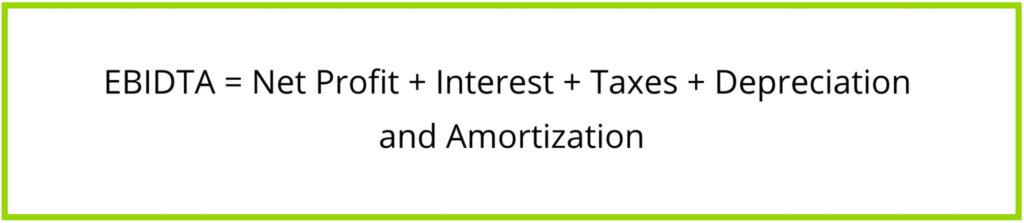

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a financial metric used to measure the overall financial performance of a business to obtain the valuation for a medium to large company.

Apply the SaaS multiple to EBITDA if your startup has grown considerably and brings in more than $5 million in annual revenue. There are two formulas that you can use to calculate EBITDA:

Use whichever provides a more realistic assessment of your startup’s earnings potential.

Why use EBITDA for Startup Valuation?

The valuation method changes as a business transforms from an owner-operated startup into a more complex organization. The latter is likely to have many multiple stakeholders, distributed ownership structure, and defined thought leadership. A valuation based on EBITDA takes all of these realities into account to achieve a more accurate result.

What is Seller Discretionary Earnings (SDE)?

SDE is a cash-flow-based metric that’s primarily used to value small businesses. It represents the total financial benefit a single, full-time owner and operator of the business would obtain annually. The SDE model is commonly used for startups that have under $5 million in annual revenue.

If your startup fits this profile, find its value by applying the SaaS multiple to SDE. You can calculate SDE by deducting the operating expenses and all costs of goods sold and then adding back your compensation to the profit number. Use this formula to quickly calculate SDE:

Why use SDE for Startup Valuations?

Adding back owner’s compensation allows us to ascertain the true potential of the startup’s earnings power as most small businesses are heavily owner-reliant. The owner may pay themselves a salary that’s higher than the market rate. Or they may write off certain personal expenses through the business for tax efficiency. So adding these back provides a clearer picture of the earnings potential.

Using Revenue for Startup Valuations

It’s common for startups to focus entirely on growth initially over profits. Once they reach the desired scale, they can reduce marketing and product development spending to increase profitability.

If you’re doing that at your startup and its SDE or EBITDA is effectively zero, find the valuation by applying the SaaS multiple to revenue. Your projections about expected growth need to be solid to convince buyers of the potential. Back it up with research-based evidence to make a strong case for the valuation.

Startup SaaS Valuations – Conclusion

If you work with a SaaS marketing agency, SaaS consultant, or even a startup marketing agency, they may or may not know about proper SaaS valuations. Therefore, you need to do your own research. Apparently, you already do!

So, everything that you’ve read so far has led you to this moment. Now all you need to do is utilize this information to calculate your startup’s value. Remember, it all starts by first deciding what your SaaS multiple is.

Once you know what it is just apply that multiple to whatever pillar of SaaS startup valuation that suits your business. If you’re a small business, it’s most likely going to be SDE. If you’re a larger business with a significant operational base and you expect massive growth, choose EBITDA.

Apply the multiple to your earnings or revenue and you’ll have the approximate value of your startup. This then becomes the starting point of all discussions with potential buyers when you decide to sell your startup. They might disagree with your valuation or challenge the methods used to calculate it to negotiate a favorable deal. But you’ll be talking to them from a position of strength as you know full well that the valuation is based on solid data and evidence.

Remember to be honest about the things that may affect the future of your business. This way, your position in the negotiations isn’t undermined if investors ultimately find out about them. As long as your valuation is based on concrete data, you can rest assured that it won’t even be that far off from a professional valuation.

Andrew Gazdecki is a 4x founder with 3x exits, former CRO, and founder of MicroAcquire. Gazdecki has been featured in The New York Times, Forbes Inc., Wall Street Journal, and Entrepreneur Magazine, as well as prominent industry blogs such as Mashable, TechCrunch, and VentureBeat.