This is why knowing how to predict churn -and prevent churn in the first place- is so important.

What’s more, customer churn is relevant to most kinds of businesses, regardless of their size. It is essential to all SaaS businesses but it also applies to eCommerce, any business with a subscription-based pricing model or recurring customers/clients, and also many companies that offer services.

So let’s get started by understanding what exactly is customer churn.

What is Customer Churn?

Customer churn, also known as customer attrition or customer turnover, is the rate at which customers stop using the service/ product of a certain business.

In simpler words, it’s when customers leave or “churn away” from a business. It’s a concept that applies to various industries, from subscription-based services to retail and beyond.

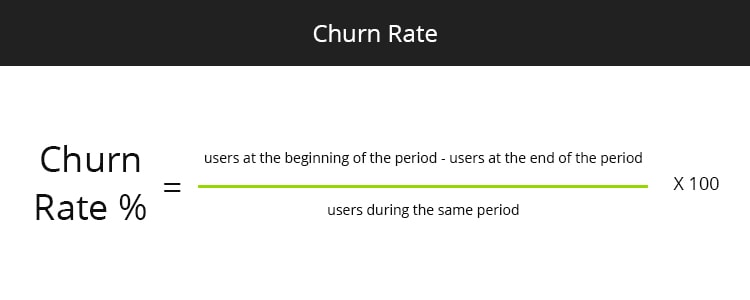

Customer churn is a rate, therefore, a number. The formula to calculate this number is as follows:

For example, let’s say that a company has 100 customers on the 1st of July. During this month, 10 of the existing customers leave and 20 new customers come. Then, according to the formula, the churn rate is 10/100+20 —> Churn rate = 8.3%

Last but not least, we should mention that customer retention is the exact opposite of customer churn.

The importance of customer churn

Customer churn is crucial because losing customers means losing the very fuel any business runs on. And acquiring new customers is expensive and time-consuming, so that’s the importance of customer retention – and why you should minimize customer churn.

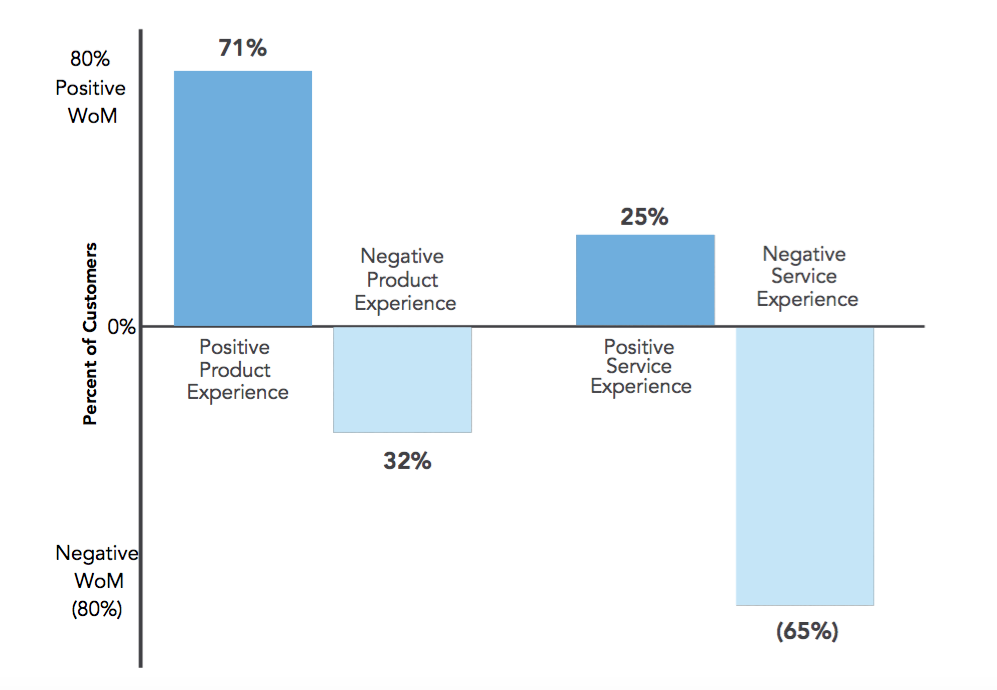

When customers cease their relationship with a company, it not only results in the loss of their current revenue but also the potential revenue from future purchases. Additionally, loyal customers often generate more revenue and can even become brand advocates, bringing in new customers through word-of-mouth.

In other words, retaining customers is more cost-effective than acquiring new customers.

What’s more, improving the churn rate means building long-term relationships with existing clientele while ensuring steady growth.

Customer Churn Prediction

Are your customers going to leave? Or aren’t they going to stay?

That is the question.

But since this is not a Shakespearean drama we better put any existential concerns aside and embrace science instead.

Metrics for Churn Prediction

Key metrics for churn prediction…

Churn Rate: As we said, Churn Rate represents the percentage of customers who stop using the service/ product of a certain business. According to common knowledge, a good churn rate for SaaS companies is considered to be 3-5%. You can take a look at the beginning of the article for the churn rate formula.

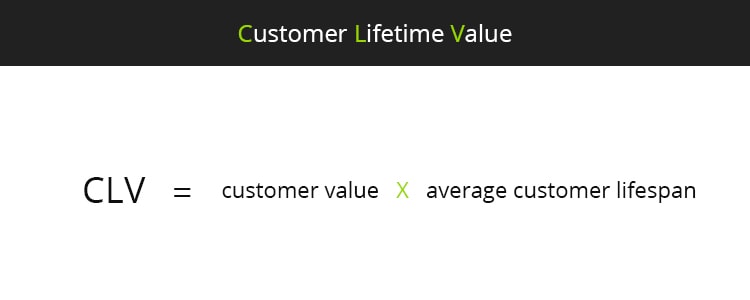

Customer Lifetime Value (CLV): CLV is the predicted net profit a customer generates throughout their entire relationship with a business. By calculating CLV, you can identify high-value customers and allocate resources to retain them.

Customer Satisfaction (CSAT): ‘From 1 to 5, how would you rate your overall satisfaction with the [goods/service] you received?’. The answer to this question, and its alternatives is what ‘How would you rate your overall satisfaction with the [goods/service] you received?’ will define CSAT. This type of question usually appears in customer feedback surveys.

Net Promoter Score (NPS): NPS gauges customer loyalty and likelihood to recommend the product or service to another person. It’s also one of the best metrics for word-of-mouth marketing.

Net Promoter Score:

… and a few other metrics to keep in mind for churn prediction.

But here is more than hard metrics. Here are a few other signs you can read that can help you with predicting churn.

Customer Complaints & Support Tickets: Monitor the volume and nature of customer complaints and support tickets to provide valuable insights into areas of concern or dissatisfaction. Frequent complaints or unresolved issues may indicate potential churn.

Usage Patterns: Analyze customer usage patterns, such as changes in usage frequency, drop-offs in specific features or modules, or decline in overall product usage to indicate potential churn. Identifying usage anomalies helps target customers who might need additional support.

Onboarding Completion: Track the completion rate of onboarding processes or initial setup tasks to help assess how successfully customers are integrating and adopting your product or service. Customers who struggle with onboarding are more likely to churn.

Customer Feedback and Surveys: To gather feedback, you can do surveys, send feedback forms, ask for online reviews, and conduct phone interviews to shed light on customer sentiment, pain points, and expectations. Analyzing this feedback helps identify areas for improvement and reduce churn risks.

Social Media Mentions: Monitoring social media platforms for mentions of your brand or product can reveal customer sentiment, identify dissatisfied customers, and address their concerns promptly. What’s more, responding to negative feedback can help mitigate churn risks.

Customer Churn Prediction in SaaS companies

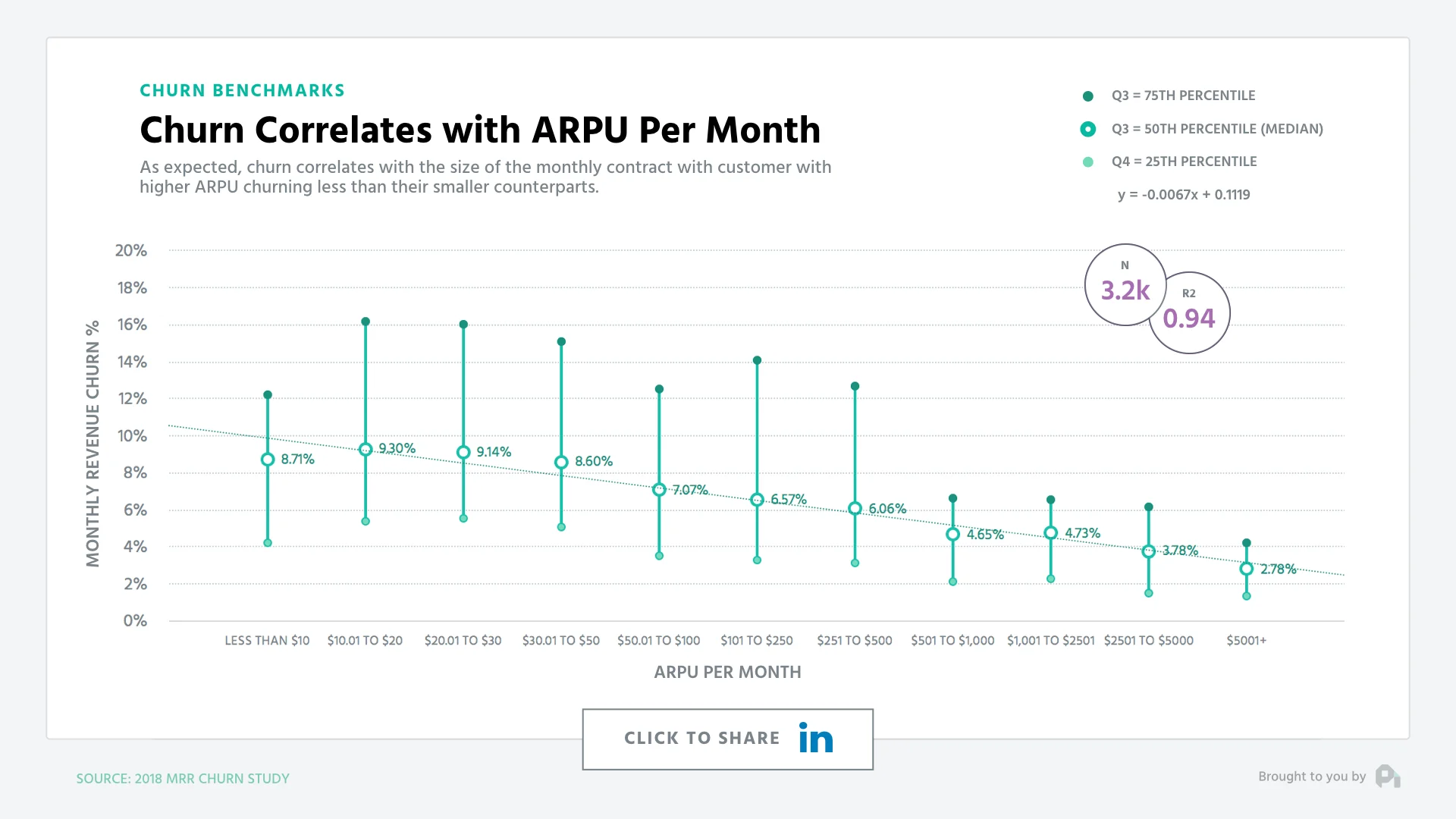

In one of the biggest studies for churn prediction for SaaS companies, Profitwell compiled a large SaaS MRR churn dataset, to answer the question “What should our churn look like?”.

Here are the findings that will help you with churn prediction, especially if you are a SaaS company. If you aren’t, it’s still very likely that this data still holds more true than false and can give you the right direction.

Churn vs. MRR: Churn only loosely correlates with MRR (Monthly Recurring Revenue)

Theoretically, it would make sense that the more money a company makes, the less the churn rate becomes, due to higher expertise, better infrastructure, economies of scale, etc. As it appears, this is not the case.

Churn vs. ARPU: Higher ARPU (Average Revenue Per User) correlates to less churn

There is a strong correlation between a higher ARPU and lower churn rates. Companies with four-figure ARPU have nearly a 50% drop in churn compared to those with single or double-digit ARPU.

This correlation makes sense because a high ARPU usually means a high-ticket product or service. And at higher tickets, companies usually equip a sales team and longer contracts, among other factors, all of which help reduce churn.

Churn vs. VC Funding: Churn 20-30% higher with funding

Companies that have been funded typically have around 20-30% higher churn rates than the bootstrapped ones. The reason for this is not entirely clear, but it’s speculated that having money in the bank means that the marketing team may focus more on top-of-the-funnel growth instead of customer retention.

Churn vs. Age: Older company correlates to less churn

For this particular conclusion, we shouldn’t confuse correlation with causation. The older the company, the lower the churn, because low churn is one of the main reasons the company managed to stay alive for so long in the first place.

Customer Churn Prediction Models

The best way to predict anything is to create a model. Accordingly, for a customer churn prediction, you also need a model; a churn prediction model.

That said, creating a churn prediction model is an advanced task, usually performed by a data scientist or a growth marketing agency / SaaS marketing agency that either works with a data scientist or has such a professional on board.

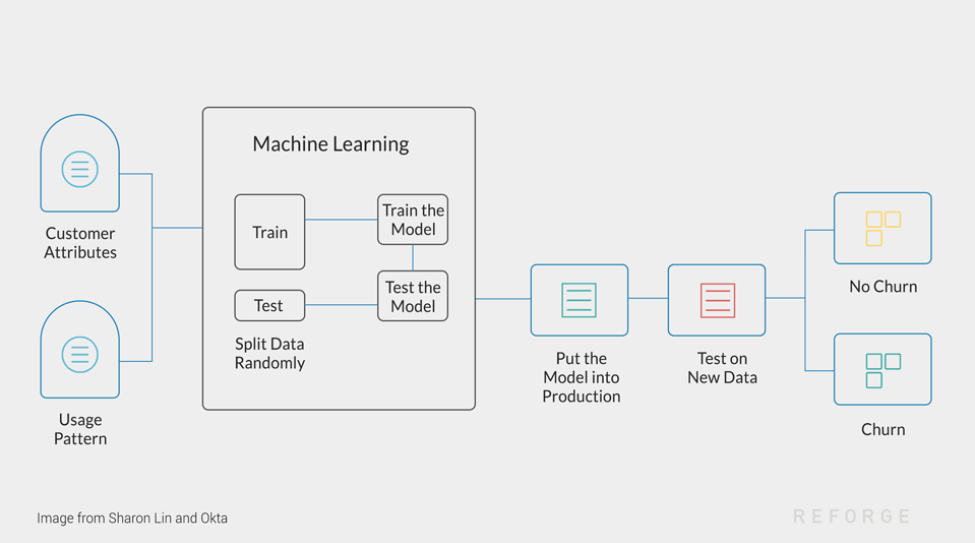

Today’s churn prediction models are made with the help of machine learning.

While there are many different such models, all of them are built similarly; they ise use data analysis and machine learning techniques to predict and understand factors that contribute to customer retention.

How to build a prediction model, along with its nuts and bolts should be an entire article on its own so here is the general idea of creating customer retention models and the basic steps it includes.

a. Problem definition: Clearly define the goal of the customer retention model. Determine what “retention” means for your business. In other words, specify the time period or criteria used to identify retained customers.

b. Data Collection: Gather relevant data and variables about your customers. This kind of data usually includes:

- Demographics

- Customer behavior data

- Customer engagement data

- Customer satisfaction

- Feedback data

c. Data Split: Split the data into training and validation sets. The training set will be used to build the retention model, while the validation set will be used to assess the model’s performance.

d. Model Selection: Choose an appropriate machine learning algorithm for your retention model. Commonly used algorithms include logistic regression, decision trees, random forests, support vector machines, or gradient boosting algorithms.

e. Model Training: Train the retention model using the training dataset. The model learns the patterns and relationships between the input features and the target variable (retained or not).

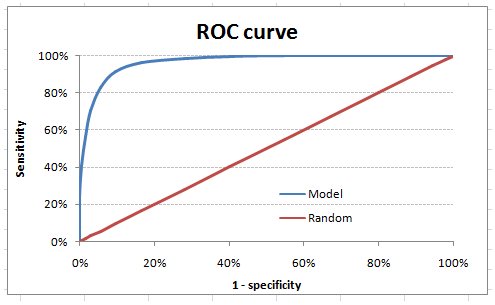

f. Model Evaluation: Assess the performance of the retention model using appropriate evaluation metrics such as accuracy, precision, recall, F1 score, or area under the ROC curve (AUC-ROC). Evaluate the model’s ability to predict customer retention accurately using the validation dataset.

g. Model Refinement: This step involves fine-tuning the model to achieve better accuracy, predictive power, and performance overall. The way to achieve that is by adjusting hyperparameters, trying different algorithms, or modifying feature engineering techniques.

h. Deployment and Monitoring: Now that your model is fully developed and optimized, it’s time to deploy it in your operational systems, customer success software, or customer relationship management (CRM) platforms. From then on, you should start monitoring the model’s performance. Every now and then, you should also retrain the model.

i. Actionable Insights: Now should be able to have a clear understanding of what’s going on regarding customer churn for your company. You will also be able to identify the key factors contributing to customer churn (see below).

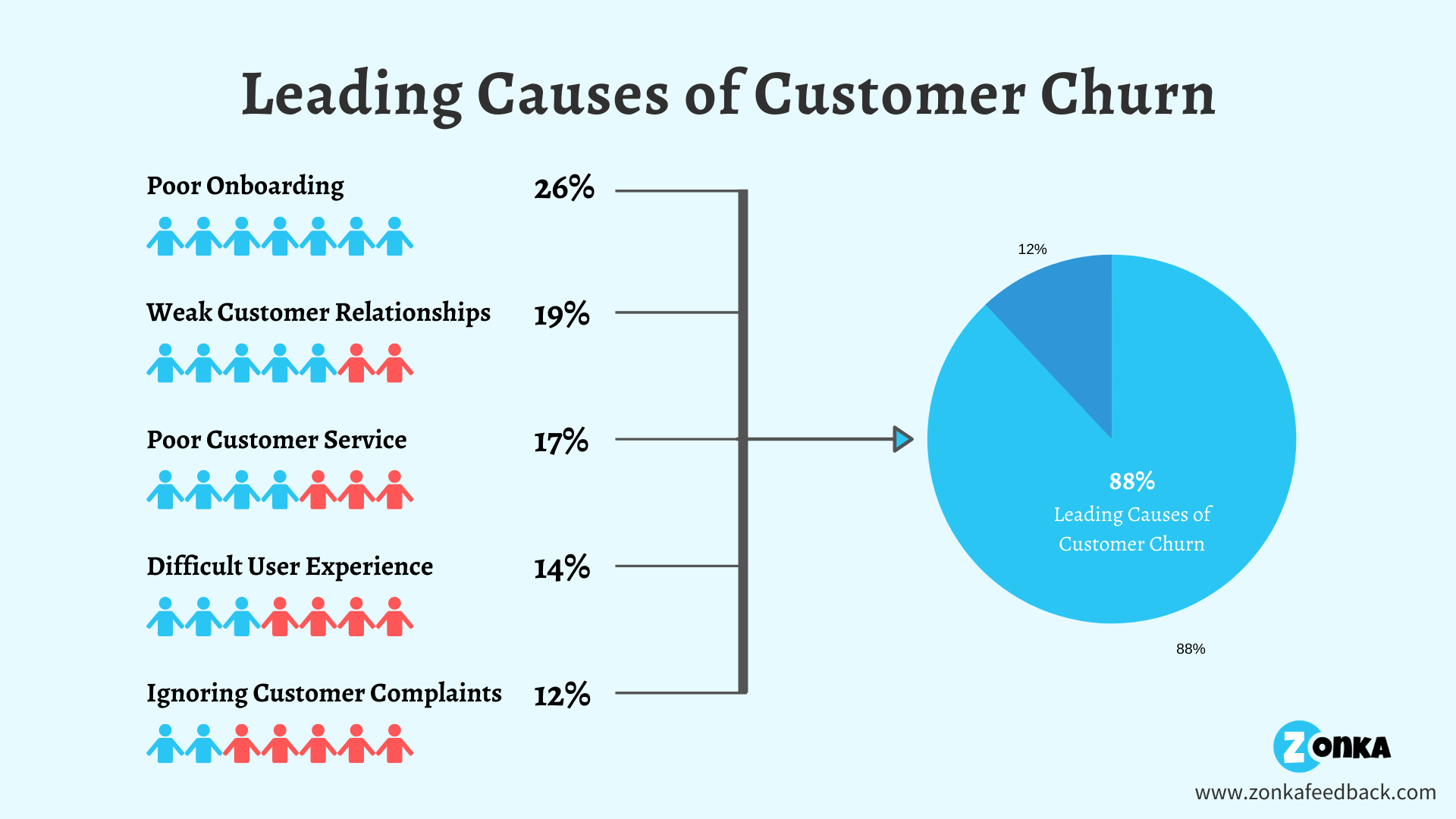

Customer Churn Prevention: The 9 Most Common Factors

Although churn prediction is vital in increasing customer retention, customer prevention is as, if not more, powerful. Surely, these tactics for customer churn prevention will come in handy.

1. Poor Customer Service

❓ Problem

Customers who experience inadequate or unsatisfactory customer service are likelier to churn. This can include slow response times, unhelpful support staff, difficulty resolving issues, or a lack of personalized attention.

💡 Solution

Invest more in your customer support team. Consider adding support channels, such as live chat and chatbot, or building a knowledge base to address customer inquiries and issues quickly. Regularly gather customer feedback to identify areas for improvement and monitor customer satisfaction with support interactions.

2. Competitor Offerings

❓ Problem

Customers may be enticed to switch to a competitor if they perceive better value, features, or pricing. Strong competition in the market can lead to customer churn, especially if your business fails to differentiate itself effectively.

💡 Solution

Conduct a competitive analysis to understand your competitors’ strengths and weaknesses. Additionally, you may differentiate your product or service by highlighting unique value propositions, superior features, or benefits that set you apart. Continuously innovate and stay ahead of the competition by regularly updating and enhancing your offerings based on customer needs and market trends.

3. Price Increases

❓ Problem

Significant or frequent price increases without corresponding improvements in value can lead to customer dissatisfaction and churn. Customers may feel that the increased cost outweighs the benefits they receive, prompting them to seek cheaper alternatives.

💡 Solution

Evaluate the pricing structure regularly to ensure it aligns with the perceived value of your product or service. Communicate any price changes well in advance, highlighting the additional value customers will receive. Consider introducing tiered pricing plans to cater to different customer segments. Offer loyalty programs, discounts, or special promotions to reward existing customers and mitigate the impact of price increases.

4. Poor Onboarding or User Experience

❓ Problem

If customers find it challenging to get started with your product or service or encounter usability issues, they may become frustrated and opt for a competitor with a smoother onboarding process or a more user-friendly interface and overall user experience.

💡 Solution

Streamline and simplify your onboarding process to ensure customers can quickly and easily start using your product or service. Moreover, provide an intuitive user interface, clear instructions, and interactive tutorials to guide customers through the initial setup. Conduct user testing and collect feedback to identify and address any usability issues or friction points.

5. Lack of Engagement or Relevance

❓ Problem

Customers who do not actively engage with your product or service over an extended period are at a higher risk of churn. If customers fail to find ongoing value or relevance in your offering, they may perceive it as unnecessary and discontinue their subscription.

💡 Solution

Continuously assess and enhance your product or service to align with changing customer needs and preferences. Regularly communicate product updates, new features, or use cases to customers to encourage ongoing engagement. Furthermore, implement personalized communication strategies, such as targeted emails or in-app notifications, to remind customers of the value they can derive from your offering. Lastly, you can offer customization options or add-on features to cater to individual customer requirements.

6. Negative Word-of-Mouth or Reputation Issues

❓ Problem

Negative experiences shared by existing customers or poor online reviews can impact potential customers’ perception of your brand and influence their decision to churn.

💡 Solution

Monitor and manage your online reputation actively. Respond promptly and professionally to negative feedback or reviews, addressing customer concerns and offering resolutions. Proactively encourage satisfied customers to share their positive experiences through testimonials or referral programs. Focus on delivering exceptional customer experiences to generate positive word-of-mouth and build a strong brand reputation.

7. Changing Customer Needs

❓ Problem

Customers’ needs and priorities can evolve over time. If your product or service no longer aligns with their changing requirements, they may start seeking alternatives.

💡 Solution

Stay attuned to market trends and evolving customer needs through market research, customer feedback, and industry insights. Adapt and expand your product or service offerings to align with changing demands. Additionally, again proactive customer communication and segmentation to understand individual needs and offer tailored solutions.

8. Relocation or Business Changes

❓ Problem

In certain cases, customer churn can occur due to external factors such as a customer relocating to a new area where your product or service is not available or experiencing business closures or downsizing.

💡 Solution

Where possible, explore opportunities to expand your service to new locations or adapt your offerings to accommodate customers’ changing circumstances. Also, consider partnerships or collaborations to offer alternative solutions in cases where your product or service is not available in a particular area. What’s more, you can offer flexible contract options or temporary suspensions to accommodate customers undergoing business changes.

9. Contract Expiration or Renewal Issues

❓ Problem

Customers on fixed-term contracts may choose not to renew their subscription if they are dissatisfied with the service or find better alternatives before the contract end date.

💡 Solution

Proactively engage with customers nearing the end of their contracts to understand their needs, address any concerns, and highlight the value of renewing. Additionally, incentives or exclusive offers for contract renewals to encourage customer loyalty. Lastly, regularly assess and optimize your renewal process to make it seamless and convenient for customers to continue their relationship with your business.

Conclusion

Retaining customers doesn’t feel as exciting as getting new customers.

But that shouldn’t stop any business from making the reduction of customer churn one of their top priorities.

Especially for SaaS businesses, focusing on the churn metric will not only allow them to grow quicker, but it will also help them with their SaaS valuation.

I write for GrowthRocks, one of the top growth hacking agencies. For some mysterious reason, I write on the internet yet I’m not a vegan, I don’t do yoga and I don’t drink smoothies.